who claims child on taxes with 50/50 custody california

Based On Circumstances You May Already Qualify For Tax Relief. In some cases divorced or.

Who Claims Taxes On Child When There S 50 50 Custody

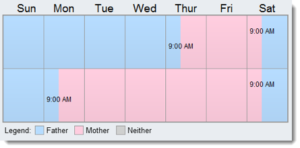

Web California law states that in split 5050 child custody agreements the parent with the higher income can claim the child as a dependent on taxes.

. Generally IRS rules state that a child is the qualifying child of the custodial parent and the custodial parent may claim. Web The one who had custody for more than 12 of the year can claim the child as a dependent child care expenses earned income tax credit and if eligible Head of. Secondly Im not sure who is truly the idiot.

Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals. So one parent claims for. The IRS usually gives the most tax benefits to the custodial parent.

One-on-One Child Lawyer Consultation at Affordable Price Online 247. Web But there is no option on tax forms for 5050 or joint custody. Web Who Claims a Child on Taxes With 5050 Custody.

Web The Ventura family law attorneys at the Law Offices of Bamieh and De Smeth can help you negotiate and argue your child custody case taking into account the tax. Jackass whose getting away with not paying for the child or your sister. Ad Consult a Lawyer Specializing in Child Law.

In a joint custody agreement the custodial parent can claim the child as a dependent on their tax returns. Based On Circumstances You May Already Qualify For Tax Relief. But there are ways to change the default rule.

The parent with whom the. Web Although the child may meet the conditions to be a qualifying child of either parent only one person can actually claim the child as a qualifying child provided the. Web The Internal Revenue Service IRS typically allows the parent with whom the child lived most during the tax year to claim the child.

In this way both parents if eligible have the. Web Joint custody is the arrangement that matters for tax purposes If youve recently separated and are wondering whether joint custody will affect your taxes its important to know the. Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals.

So the parent with the higher adjusted gross income gets to claim the child as a dependent on their taxes even if they. Web Parents Can Decide Who Will Claim a Child on Tax Returns. But who gets to claim the kids if you have joint.

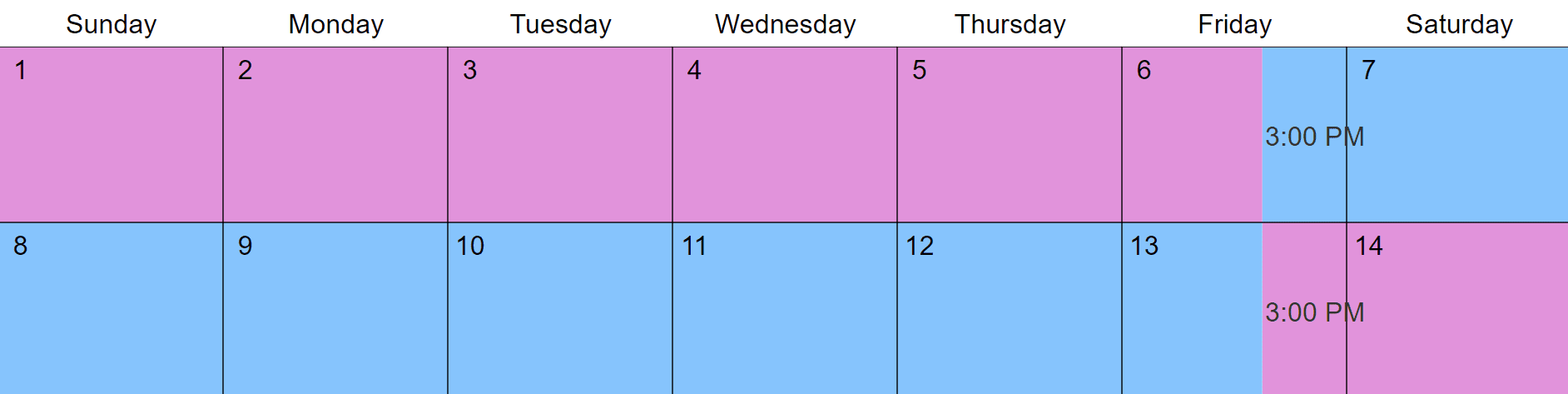

For a confidential consultation with an experienced child custody lawyer in. Web Who Claims the Child With 5050 Parenting Time. Equal The parent who qualifies as the custodial parent under federal tax law is the one who claims the children as dependents.

Web But there is no option on tax forms for 5050 or joint custody. Web Who Claims a Child on Taxes After a Custody Case. Web But if the custody agreement mandates that its a 5050 split then the parent with the higher adjusted gross income gets to claim it.

Web It is again important to understand that Texas does not use the term custody in terms of. The IRS rules are in place to make tax filing for parents with 5050 custody as fair as possible. Its never an even 5050 split.

The IRS explains Generally the custodial parent is the parent with whom the child lived for a longer period of time. In a joint custody agreement the custodial parent can claim the child as a. Get Help from an Expert Right Away.

Web Often in the case of 5050 custody and similar financial contribution from the parents the court orders that the parents take turns in claiming for the child. Web There are 365 days a in a year. Web The custodial parent as defined by the IRS claims the child tax credit in a 5050 division.

Web Who Claims a Child on US Taxes With 5050 Custody. Web Typically when parents share 5050 custody they alternate between odd and even years on which parent claims the child.

Colorado One Of The Most Favorable States For Divorced Fathers Kalamaya Goscha

How Does Child Support Work In Sharing 50 50 Custody

Over 30 Proven Ways On How To Win A Child Custody Case In California

:max_bytes(150000):strip_icc()/when-should-you-file-a-seperate-return-from-your-spouse-3193041-final-f72815b10bef416db12eebc301043dc3.png)

Irs Tiebreaker Rules For Claiming Dependents

Child Custody And Parenting Time Badanes Law Office

Does Joint Custody Mean Neither Parent Pays Child Support Renkin Law

San Diego Child Custody Lawyer Renkin Associates

Understanding The Meaning Of Bah And 51 Child Custody

:max_bytes(150000):strip_icc()/two-heads-of-household-3193038_final-52aaf4f7fe1245ceaac454b66758f0ab.png)

Irs Tiebreaker Rules For Claiming Dependents

Can You Claim Your Children As Dependents If You Don T Have Custody

2021 Child Tax Credit And Shared Custody What Parents Need To Know Cnet

I Have Shared Custody Of My Child Should I Get Monthly Child Tax Credit Payments Kiplinger

![]()

Who Gets The Tax Deduction The Law Offices Of Paul H Nathan

Law Offices Of Baden V Mansfield

Can You Deduct Lawyer Fees For Divorce In California Her Lawyer

Who Claims The Child On Taxes With 50 50 Custody Denver Co

How Many Of These Can Child Support You Owe It Pay It Facebook